NASHVILLE | Last Wednesday, (Nov 13) I had the privilege of joining Bass, Berry and Sims and Deloitte at the 2013 Health Care Investors Conference. I sat down with Brad Smith, CEO of Aspire Health; Andrew Lasher, CMO of Aspire Health; and Anna Gene O’Neal, CEO of Alive Hospice, to discuss some of challenges and opportunities in end-of-life care today, and how we believe a new partnership can help.

End-of-Life care is positioned strategically for both the individual and the nation. Transitioning from a volume-based system to a value-based system requires a new model. We don’t have enough money to provide everything to everyone. At the same time, palliative care is needed at an intimate and chaotic time in people’s lives. Most people are not spending the last few years they way they want to—they don’t die the way they want to die.

Something has to change. Fee-for-service payment models will not sustain palliative care or even hospice. There has to be a forward-thinking to deliver these services in way that cost effective for the companies providing care. No one has been able to do this sustainably in the pure for profit or non-profit sector. The question that Smith, O’Neal, Lasher and I discussed is, “Can we meet this need by marrying for- and non-profit organizations with similar missions and goals?”

Andrew Lasher pointed out that palliative care is both a new field of medicine and the very oldest. In the past, it was the only thing medicine had to offer. Now we are good at managing chronic illness. We are prolonging life, but not comfortably. We need more physicians with training to merge the treatment of chronic illness with a palliative frame work. Currently, our teaching programs are not doing this quickly enough.

I agree. We have lost the connection between the physical, medical patient and the emotional, spiritual individual. Palliative care is what my dad used to practice in the mid 1900s. He used a holistic view of the patient to offer treatment and comfort as coinciding services –not separate options. In the current model, treatment and comfort are addressed as a decision point resulting in diverging paths where they should be travel companions.

Alive Hospice is striving to do end-of-life better, said Anna Gene O’Neal. The average daily census at Alive Hospice is more than 480 patients. Alive is the only hospice with both adult and pediatric services. They are front runners in the field in both their concept and their forward thinking. They focus not only on shepherding patient through the end of life, but also caring for families in the bereavement phase.

Alive is also taking on the responsibility of community education. They launched The Gift Initiative this month, a program to encourage everyone to have end of life conversations with their families. “Are we challenging ourselves to define what we want at the end of life instead of letting a fragmented healthcare system do it?” O’Neal asked.

Lasher pointed out that the biggest difference between hospice and palliative care is not the disease, but the patient’s preferences. Is the patient treatment-focused or comfort-only-focused? Does the patient still want chemo or dialysis? If so, they can’t go to hospice, but they are still hospice eligible and need 24/7 responsiveness, comfort support and spiritual support. Aspire seeks to remove the difficult choice and provide patients with both options as an integrated treatment plan.

There are people across the country doing palliative care the way we are describing it, but they are doing it on a small scale. There are several models. Large healthcare systems have done it because it is the right thing to do. Inpatient hospitals have also developed it because it is needed. And then there are some palliative care MDs who have built a private practice. However, these are all small scale, and cannot bear the volume of patients who need these services.

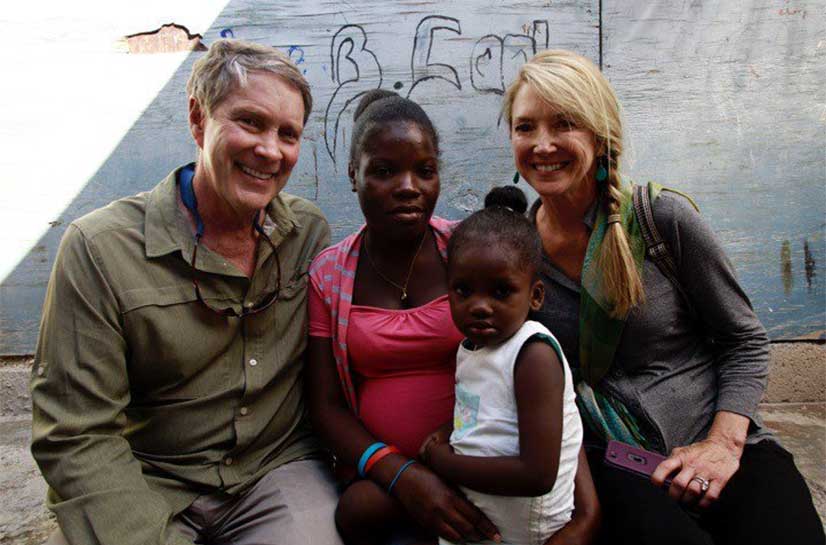

Aspire wants to partner with other groups like Alive Hospice and build a comprehensive service, said Brad Smith. 80% of the markets across the country have a person—not a company—doing this.

In O’Neal’s experience, there are lots of patients that are hospice-eligible but not hospice-ready. They have less than six months to live, but are not ready to withhold medical treatments. From Aspire’s perspective, the right thing was clear: serving these patients so they can get medical continuity of care, quarterbacking their resources—all the specialists—and giving them palliative care without using hospice specifically. But the current payment model is not sufficient to support this ideal and there is not enough volume to show the payers this. Right now these patients are just “dust on the balance sheet,” she said.

Providing this bridge service is the right thing to do, but it is causing a monetary loss. This is where I see a huge opportunity to lobby payers and push payment reform to support these services. Aspire Health and Alive Hospice together bring expertise to the table that will create value and show the payers they can make money.

The biggest issue is figuring out how to contract with the payers, said Smith. There are lot of unknowns about enrolling patients, volume and triaging patients, making it difficult to make a value-based argument to a health plan.

Partnering with Alive has allowed us to start answering these questions so we can better liaise with payors. Physicians are excited about delivering care in a more scalable way. If we can get the payors on board, we have a new business venture.

What does this new model look like practically? Andrew Lasher described a 65-year-old patient with heart failure and very advanced emphysema who was short of breath and in pain. The patient had been admitted to the hospital seven times in the six months before enrolling at Aspire. His wife, his primary caretaker, chauffer, and breadwinner, was exhausted. In his condition, serious problems emerged with no warning.

Aspire’s first step was to arrange 24/7 support. He has IV diuretics at home, and a physician network on call. In the three months since enrolling, he’s had one hospital admission.

Keeping patients out of the hospital prevents delirium and infections and decreases the strain on caregivers. The patient says he feels better. This is different from home health, Lasher explains, because home health is limited in time and the scope of issues they can address. However, Aspire is a physician supervised network that can diagnose and treat new problems as well as provide ongoing care of existing ones.

The cost model here is different. It truly merges quality of care with cost savings in a very tangible way. Decreasing hospitalizations is clearly cheaper than home based care to the system. The issue is that if there is a fragmented set of payors you may save a hospital money, but not the home health care company.

Brad Smith explained for a patient at the very end of life—two to three months to live—costs can be about $50,000. But Aspire’s approach can reduce those costs by $10,000 to $20,000. It hasn’t been as hard to sell this to health plans – groups that cover all aspects of a patients care under one roof – because when the health plans run the data they realize their potential cost savings!

The risk of this model is that this has not been done before at this scale, but as the healthcare sector changes, the bearer of that risk is changing. Governments and payors used to bear the majority of the risk, but that is shifting to providers and patients—the very people who most benefit from this model. Realigning the payor system to pay for this increased quality and merge the savings of a prevented hospital stay to cover the cost of in home palliative care and care coordination will make this model profitable and do what we all know is best for patients simultaneously.